Pradhan Mantri Fasal Bima Yojana (PMFBY 2020) List [Crop Insurance Scheme Online Portal/offline Application Form PDF Process Status, Eligibility Criteria, Documents, Premium Amount, Mobile App, Risk @pmfby.gov.in]

India has a population of millions that is growing at a steady rate. Without proper supply of food crops in the market, it will be impossible for the country’s government to maintain balance. Thankfully, India is an agricultural country, and most farmers are associated with the cultivation of crops. It will be impossible for the people of this nation to survive without the hard work of these farmers. Even the government understands the crucial role that these farmers play in the progress of the nation. But these food crop growers are not in good condition. Most live below poverty line as they fail to get the right price for their crops, due to several reasons. For the benefit of these agricultural workers, the central government has implemented a new project under the name Pradhan Mantri Fasal Bima Yojana (PMFBY).

Launch details of the scheme

| Name of the scheme | Pradhan Mantri Fasal Bima Yojana / PMFBY / Crop Insurance Scheme |

| Official date of launch | January 2016 |

| Announced by | PM Narendra Modi |

| Target beneficiaries | Agricultural labors or farmers |

| Responsibility of supervision | Agriculture, Cooperation & Farmers Welfare Department |

| Last application date | August 2018 |

| Schemes placed under this yojana | Comprehensive Crop Insurance Scheme, Experimental Crop Insurance, Farm Income Insurance Scheme, National Agriculture Insurance Scheme |

Key features of the Fasal Bima Yojana

- Combining other agro insurance schemes – Before the implementation of this project, several agricultural related insurance schemes were active. It was both complex and difficult to keep track of all these schemes. For better management and monitoring, central government places all early agro insurance schemes under PMFBY.

- Inclusion of all farmers – Previous schemes allowed only specific farmers to enroll under it. Some were for big farmers while others were for smaller agro producers. With the implementation of this project, we got an insurance scheme that allowed farmers from all categories to enroll and get benefits.

- Insurance at low premium rates – Other private crop insurance policies are rather costly. It is not possible for poor farmers to pay such hefty premiums. With PMFBY, one need not worry about this issue. The scheme has fixed the premium at only 2% for Kharif and 1.5% for Rabi crops.

- Mode of payment for insurance – In case the farmer needs to claim the insurance money, central government will transfer the amount into the bank account that is in the name of the farmer.

- Coverage under the scheme – Farmers will end up paying only a smaller fraction of the insurance premium. The bigger chuck will be offered by central government. But each policy holder will receive full coverage against crop damage.

- Tax exemption – No matter how much the farmers are paying as their premium share, no tax will be calculated on that sum. Thus, there is no need to worry about paying tax on that amount.

- Calculating insurance premium – Whether the farmers log on to the site or download the app for this scheme, they will be able to take the assistance of premium calculator feature. It will assist the farmer to get the exact amount that he needs to pay a premium for this insurance coverage.

- Nomination facility – Every insurance scheme comes with nomination facility. But as of now, there is no such nomination registration for PMFBY. It will be in the name of the main farmer alone.

- CEO appointed : Prime Minister Crop insurance scheme has selected Ashish Kumar Bhutani as the CEO of Pradhan Mantri Fasal Bima Yojana scheme. Bhutani has been appointed for the post till May 2020.

Eligibility criteria for the scheme

- No worries about classification for farmers – Under this insurance coverage scheme, no farmer needs to worry about any classification. Big, small, as well as marginal agricultural workers will be allowed to get the benefits of this project.

- For owners as well as rented farmers – Unlike previous schemes, the PMFBY will allow both landholding as well as landless farmers to get the coverage benefits. Landless farmers mean those who produce crops on another person’s land.

- Non- loanee farmers – There are several agricultural workers who have not taken any loan from any bank or the government, for agricultural needs. These individuals are termed as non-loanee farmers. In case any such farmers desire to get the benefits of this project, they need to publish land documents.

Necessary documents for registration under PMFBY

- Land registration papers – Only those farmers will be able to fill in the application to get the benefits of this insurance scheme that have access to all registration papers of the farmland. It applies for land owners as well as rented farmers. They need to have the land patta number.

- Ownership papers of farmland – In case the farmer is the real owner of the farmland, then he needs to attach copies of those legal documents, which highlight that the land is registered in his name.

- Aadhar card – Attaching a copy of the Aadhar card is a must for all farmers. It will be used for background checks by the authority.

- Personal identification proof of registering farmer – The PAN card, voter card and ration card photocopies of each farmer must be attached with the application form. All personal identification details are a must for application.

- Details of official bank account – As the insurance money will be offered via the bank, the farmers need access to active bank accounts. Details like bank and branch name, account code, back code and address are a must for proper money transfer.

- Sowing information – In case any unfortunate incident takes place; government will need sowing details for compensating the loss. It will highlight the actual investment on the part of the agricultural labor, and the amount he has lost due to the losses. The papers which offer these details are termed as sowing declarations.

- Application form – Last but not the least; all applicants need to collect the application forms from respective central or state government offices. The form has to be filled in carefully. In case it has any wrong info, it will be rejected by the scrutiny department.

From where can one obtain online registration form?

Any farmer who wants to safeguard their crops and investment against damage can go online to register under PMFBY. The digitized application form can be accessed by landing on the official homepage, by clicking on the link http://pmfby.gov.in/. If one wants to bypass the primary steps, and get to the form directly, then he must click on the link http://pmfby.gov.in/farmerRegistrationForm.

How to apply for PMFBY online?

- Some changes have been made in the online application process. Any applicant who desires to enroll under this crop insurance scheme will have to click on the official link, i.e. http://pmfby.gov.in/.

- There are six separate tablets on the homepage. In case a farmer desires to apply for the first time, he will have to take the mouse pointer on the table marked as “Farmer Corner – Apply for Crop Insurance by Yourself.”

- As soon as one clicks on this link, a smaller box will emerge on the screen that has two separate options. One is “Login for Farmer” and the other is “Guest Farmer.”

- Farmers who have already applied can access other options by logging in with their credentials at “Login for Farmer”.

- For a fresh application, one has to click on the option “Guest Farmer.”

- It will trigger the site to bring up the official registration form on the computer screen. It is the revamped application form for 2018.

- All fields must be filled with appropriate data. Any error will result in the cancellation of this application.

- Once the details have been filled in, the applicant needs to type in the capchat code in the box, and click on the green button that is marked as “Create User.”

- After getting confirmation on registered mobile number, applicants must login with their credentials for filling in other details. Only then the entire registration process will be complete.

How to register any grievance Complaint?

The website has a unique feature that allows farmers to highlight any complaints or grievances as well. It will allow the department to understand if farmers are having any issues during enrollment, crop loss report submission, claim status check and any general doubt clarification. It will help the government to serves these farmers better.

- In case any applicant wants to register any complaint, then he has to click on the official web link, http://pmfby.gov.in/.

- Then he has to bring the mouse pointer on the 5th option tablet from the left. This option tablet is marked as “Complaints – Tell Us About Your Problems.”

- As soon as one clicks on this link, it will open a new page that will highlight the “Complaint/Grievance” box.

- Four fields are visible in this box. These are marked as “Name,” “Mobile Number,” “Email” and “Comments.”

- The farmer needs to type in his name, registered mobile number and email ID. Then he has to type in and describe his doubt, issue or compliant.

- Once it has been done, it is time to register to the complaint by typing in capchat code in the box marked as “Enter Capchat Code” and clicking on the yellow “Submit” button.

Role of banks and insurance agencies

It is not possible for the central or the state government to take care of all transactions alone. Thus, it has been decided that a handful of financial institutes and insurance companies will be selected by central government. These banks and insurance companies will work in unison to work out every nitty-gritty of this scheme. The insurance companies will check the truth behind the claim, while compensation transfer will be handled by the selected banks. Regional Rural Banks, Cooperative Banks, and commercial banks will do the task. Some private insurance companies will be offered the responsibility to check the claim settlement procedure. Their presence will keep third-party agencies at bay.

Types of coverage components

As mentioned, no discrimination will be done when sorting the application of farmers, under any category. To ensue most farmers receive the perks of this insurance scheme, central government will keep additional reservation for those agricultural workers who fall in schedule caste, schedule tribe and OBC groups. Other than this, there are two additional categories – compulsory and voluntary.

Compulsory component – It is associated with the SAO credit. When any farmer applies for credit from banks or other organizations, and utilizes it for reaping a seasonal harvest, then it is termed as SAO loan. All farm workers, which have attained this credit, will be categorized under compulsory component. They will not get entry under PMFBY.

Voluntary component – In case a farm worker has not taken any such loan for crop harvest, then he will automatically fall under the voluntary category. All these farmers can register and get all benefits that PMFBY offers.

Crops identified by the government

For the time being, only a handful crops have been identified by central government. Keeping the soli, climate and farming practices, the national government has taken this decision. All farmers, who grow rice, wheat, pulses, millets, castor, groundnut, linseed, cashew nut, guava, banana, and mangoes, will be able to apply for this crop insurance scheme. This list will make sure that farmers from all parts of the nation will be able to safeguard their crops as per the guidelines of this scheme. With time, more food and commercial crops will be added to this list by the central government. After all, the main objective of this scheme is to offer financial security against any accidents.

Risks covered under this scheme

The PMFBY offers protection to all farmers. But that does not mean that it will offer coverage against all incidents. The following are some coverage related details that all farmers must know about before applying for this insurance scheme:

- Loss due to prevented sowing – Framers will not be able to get satisfactory returns if they fail to sow the seeds in the insured farmland. In case this delay has been due to natural causes like lack of precipitation, then the agricultural labor can attain compensation from the government.

- Damage to standing crop – Standing time of any crop starts right after sowing of seeds till before the crop harvesting season. In case the standing crop suffers from any damage, due to natural causes, then farmers will get paid under PMFBY.

- Post yield damages – Before the product is taken to the market for sale, it needs some time for post harvesting procedures. During this time, farmers need to store the crop in a safe place. In case this crop is damaged, famers can opt for insurance claim. But that claim must be made before completion of two weeks, from the date of harvest.

- Localized incidents – Localized natural calamities are common in many parts of India. Storms might damage the harvest in one part of the state, while others, located on the opposite side remain unaffected. In case of such localized events, insurance money can be claimed.

Risks not covered under the scheme

It has been mentioned in the PMFBY scheme that government will be entitled to pay for damages only in case of natural calamities. If crops are destroyed by manmade causes, like nuclear disaster, wars, or radiation fallouts, then farmers will not receive any insurance coverage. If man-made fire chars the crops, or they are eaten by locusts or other animals, then that too will be the responsibility of the farmer. Any cause, other than natural events will not be considered under this insurance scheme.

How to calculate premium?

- For the ease of farmers, there is a unique option that will allow the applicants to calculate the premium amount. For this, one has to click on the official link of the yojana, gov.in.

- Once the home page opens, the applicant has to click on the option tablet that has been marked as “Insurance Premium Calculator – Know Your Insurance Premium Before”

- A new page will open that will allow the person to calculate the premium amount for the insurance scheme.

- The applicant has to enter whether the crop is Kharif or Rabi under the “Season” field, year related date under the “Year” filed, pick the scheme name under the “Scheme” filed, and also fill in “State,” “District,” and “Crop” fields with proper date.

- To get the final premium amount, applicants need to click on the yellow button that is marked as “Calculate”

- As soon as this button is clicked, it will trigger the site to do necessary calculations. Once the number crunching is done, it will highlight the amount on the screen. Thus, the applicant will get an idea about the total premium that he has to pay in order to safeguard his investment and crops from any damage, caused due to natural reasons.

PMFBY Android App

Along with the new and improved website, the agro department has also launched a mobile application for this scheme. For the design and launch of this app, central agriculture department took help from Information Technology department. The “Crop Insurance App” is designed for any android smartphone. Any person can download this application from Google PlayStore for no extra payment. Just initiate a search on Google PlayStore with the name of this app, and then download it easily. The application can also be downloaded from the link http://www.agri-insurance.gov.in/Document/CCE_Agri_121_27-03-2017.apk. All features, which you get on the website, are also available on this smartphone application. It will make thing easy for farmers.

Budget allocation for this scheme

It is an ambitious project, undertaken by the Modi government. During the official budget speech of 2016 -2017, FM Arun Jaitley made it clear that it will put a huge pressure on the nation treasury. During this speech he said that allocations of Rs. 550 crore had been done for proper implementation of this scheme. During 2017 budget announcement, 40% extra allocation was made towards this project that took the total cost to Rs. 9000 crores. By the end of this year, central government aims at incorporating 50% cultivable land under this project.

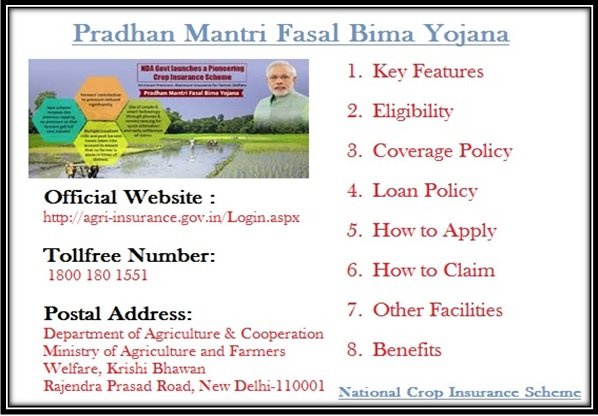

Contact details and helpline numbers

In case any farmer desires to attain any information related to this scheme, then he can dial the number 011-23382012, followed by an extension 2715 / 2709 to talk to customer care executives. Any other doubt can be cleared by logging on to the link help.agri-insurance@gov.in.

Farmers have been using this unique scheme to reduce their crop losses. Poor farmers stake everything they have on the crop yield. If that is damaged by some means, then it becomes impossible for them to recover from the loss. They choose to take their lives by committing suicide. But schemes like these have succeeded in lowering the farmer suicide percentage in the nation. The new site is still under development, and central government will notify applicants as and when any updates take place.

Updates

- Over 90 lakhs farmers have availed this scheme (PM Modi) as on 22nd August

23/07/2018

Betterment of Tripura Farmers Under Pradhan Mantri Fasal Bima Yojana

As promised by Prime Minister Narendra Modi, several central sponsored programs have already been implemented, which are targeted towards developing the sorry state of poor Indian farmers. One such scheme is Pradhan Mantri Fasal Bima Yojana. Like other areas, the scheme has been implemented in Tripura as well. But the progress of farmers, living in West Tripura district is more when compared to agricultural workers living elsewhere. Credit must be given to Sandeep Mahatme who is the Magistrate and Collector of this district, for including innovative measures, which assisted in better operation under this scheme. To encourage this task, the Magistrate has also received a reward from PM Modi.

26/07/2018

Last Date

Extended date of Crop insurance scheme Maharashtra Chief Minister

Maharashtra Chief Minister declared about the extension of online application for crop insurance scheme till 31st of July. The main aim of extending the scheme’s deadline is to provide more benefits to the farmers. Also, the local administration has been asked to help the framers while filling the online application for availing the scheme. It brings in several advantages such as reducing the issue of rural indebtedness that occurs due to the failure of crops. It also works as an anti-inflationary measure. The overall aim of the scheme is to look after the economic interest of farmers against any loss. It also provides help to the farmers in repaying all debts.

31/7/2018

Though implementation of Pradhan Mantri Fasal Bima Yojana or PMFBY has started in many parts, many farmers from Odisha have still not received the benefits. But the situation will change within 20 to 25 days. Dharmendra Pradhan, Union Petroleum and Skill Development Minister has announced that respective authority will make sure that pending applicants will be addressed and funds will be released as soon as possible. During this phase, government will offer around Rs. 352 crore as Kharif insurance payment.

(PMFBY) Pradhan Mantri Fasal Bima Yojana in Hindi

भारत देश कृषि प्रधान देश हैं इसकी आर्थिक व्यवस्था कृषि एवं किसानो पर निर्भर करती हैं. परन्तु गत कई वर्षो से किसानो की हालत बिगड़ती ही जा रही हैं उन्हें मजबूती एवम सहारा देने के उद्देश्य से फसल बिमा एक नयी कृषि से संबंधी बिमा पॉलिसी शुरू की जा रही हैं.

प्रधानमंत्री फसल बिमा योजना, किसानो के लिए कुछ हद तक राहत का कार्य करेगी, इसी उद्देश्य के साथ लोहड़ी के दिन मोदी जी ने इस योजना का ऐलान किया. इस योजना के लिए फंड केंद्र और राज्य दोनों सरकारों द्वारा वहन किया जायेगा.

प्रधानमंत्री फसल बिमा उद्देश्य, प्रीमियम एवम् योग्यता

यह योजना किसानो को उनके नुकसान की भरपाई के तौर पर शुरू की जा रही हैं जिसके अंतर्गत किसान अपनी फसलो का बिमा करवा सकेंगे जिसका प्रीमियम बहुत कम होगा ऐसा करने पर अगर किसान की फसल को नुकसान पहुँचता हैं तब उन्हें बिमा राशि उपलब्ध करायी जायेगी और इस योजना के सरलीकरण के लिए भी कई उचित फैसले लिए गए हैं ताकि जल्द से जल्द सहायता राशि पहुँचाई जा सके.

यह बिमा पॉलिसी अगली खरीफ की फसल से लागू होंगी

प्रीमियम दर

| फसल के प्रकार | प्रीमियम दर % |

| रबी फसल | 1.5 |

| खरीफ | 2 |

| तिलहन | 1.5 |

| बागवानी | 5 |

योग्यता :

प्रधानमंत्री फसल बिमा योजना के अंतर्गत कोई भी किसान अपनी फसल का बिमा करवा सकता हैं. इसके तहत बटाईदार एवम खोट की खेती भी शामिल हैं.

प्रधानमंत्री फसल बिमा योजना से किसानो को कम दर में अधिक बिमा राशि मिलेगी जिससे उन्हें उत्साह मिलेगा और देश में किसानो की स्थिती में परिवर्तन आयेगा.

Other Articles

- Mudra Scheme

- Kaushal Vikas Yojana

- Pradhan Mantri Awas Yojana Gramin

- Maharashtra Farm Loan Waiver Scheme

PMFBY is a very good scheme for us.pls inform me how can apply for scheme?

Dear Bikash,

The insurance is done through bank after getting notification from state govt. In case of loanee farmer it is compulsory which bank does according to area and crop mentioned during applying for the KCC loan , in case of non loanee farmer it is optional but he can approach bank by paying premium.

This schemes is very nice. But I don’t know how to make this schemes

Nice ,but not understanding that what is the process of scheme for start so.

process is still not clear, will update this article once it is done.

PMFBY is a very good scheme for farmers but for a village farmer its very difficult to connect to this type of schemes.

Please suggest me how I can apply for this scheme. My father already have 2 lakh bank loan for agricultural.

Dear Pankaj,

You can approach bank for the same if you have taken KCC loan.

PMFBY IS VERY GOOD FOR FARMERS LIKE ME PLEASE LET ME KNOW WHERE DO I APPLY FOR THIS SCHEME

How I can apply fasal bima

Good scheme.implement it efficiently

Seeming a good one ….looking forward to seeing well being of farmers.

PMFBY is a dynamic attempt to help farmers. Plz furnish detailed guidelines for applying.

Would like to know how to obtain the policy and other guidelies of the scheme

what are the required documents for applying pmfby.

Dear Sir/ Ma’am,

I am a finance professional working in a Pvt. Company as Sr. Manager Accounts having more than 22 years of experience in field of Accounts and Finance.

As I came to know about this Crop Insurance Scheme in various advertisements published in news paper.

My concern here is I would like to help / guide them the rural poor farmers in my area in Odihsa , Block- Rajkanika, Dist- Kendrapara because they all are not well literate enough .

Thus my request here is if possible please let me inform / suggest what type of service can provide to them with guide line through the GOVT.

Warm Regards,

Pabitra Mohan Barik.

Dear Pabitra,

All insurance companies does awareness programme during the scheme, which is part of operational guidelines . you can be able to know which company allotted to implement the scheme in your district though bank and contact them .

Respected sir,

Fasal Bima Yojna ke form khan se millege.Please btayen.

thanku

It is very effective . If it becomes online claimed

Pmfby is good sceme….but tell me how to apply this

बहुत ही सार्थक योजना है | लेकिन पूरा इंटरनेट खोज लिया , कहीं पर भी इस योजना के क्रियान्वयन पर जानकारी नहीं मिली | मतलब ये कि मान लीजिए किसी किसान को बिमा करवाना है तो कैसे करेगा ? कहाँ संपर्क करेगा ? कोई मोबाइल एप या नम्बर ? स्थानीय स्तर पर कोई ऑफिस या अधिकारी जहाँ से यह फसल बीमा होगा ? कृपया बीमा करवाने की प्रक्रिया बताएं ताकि किसानों को हम बता सकें जागरूक करें क्योंकि मन की बात में आ० मोदी जी ने नागरिकों से किसानों को जागरूक करने की अपील की है लेकिन जब प्रक्रिया मालूम नहीं होगी तो क्या बताएंगे ?

Sarkar dwara chalai ja rahi yah skeem kisano ke liy bhut achhi hi but kuch kisaan ase vi hi jinko avi vi this yojana ke bare me pta nhi hi aur kuch ko pta hi to wo kaise profit uthay i mean iske liy process kya hoga ….

Please tell me this skeem process on my email id par taki mai kuch logo ko bta saku..

Hi Team,

please let me know how to apply for this scheme.

provide step by step process.

thanks

Govinda.

We r very gretfull thanks to our PM. MODI JI. For pmfby. I want to share this yojna information with my all velligers.but i dont know its prosses.will you anybody help me about it???????.

“Pradhan Mantri Fasal Bima Yojana| crop insurance scheme” wjich is one of the big targeted scheme in our country as @ 65% of our economay is depending on the agticulture activiyies. Our PMji has launched the new scheme but iy will not reach to the entire formers. In this regard the responsibality on the soulders on the concerned CM”s has to ensure that the scheme should reach to the formers”

In india we have 2 types of formers: 1) Who are soley depending on the Agriculture by invesing their own money for growing of crops, but they are not aware and avail the insurence scheme due to lack of knowledge/ no time as they are alwaus working in their land.

2) The former who has availed the loan form the banks atomatically coverd under the insirabce scheme and who is not bother about even if crop failure the insurance will come into his protection for the entire loss.

where as in case of non loan formers they will suicide in case of failure of crops. it is the responsiblity of the Govenament to cover all non loany formers crop under insuance scheme by paying the premium thereby there is equality amoung the former community

S M Devaiah

8762820509

fsal bima yojna bahut acha hai . yadi yeh scheme success ho gaya to jaise aaj health/life/vehicle etc insured karta hai waise hi hamare kisan insured ho jayenge fasal ke liye bhi but yeh kaise hoga ? full details chahiye . yeh scheme without loan wale fasal mai bhi lagu hona chahiye….small farmer ke liye bahut acha scheme hai ur new person jo agri se dur ho rahe hai unko bhi faith hoga jis se woh agri mai career bhi dekh sakte hai….jis se employment or good food bhi milega……congratulation to ALL

dear sir,

plz let me know that what is the process of ths yojna

revart me asap

Dated: 27.02.16

fasal beema karane ke liye kya kya karna hoga

kya details deni hogi

kaun kaun se documents submit karne padenge

premium kis hisab se pay kiya jayega

premium amount reverse hota hai ya nahi, yadi koi nuksaan nahi hota tab kya hota hai

natural loss hota hai to usko kaise dikhaya jata hai aur claim kitne din baad milta hai

please tell me

If the scheme is to start from June, 16, by this time process and procedures should have been made clear and open. I have very much doubt that this scheme will be translated into reality so soon and it seems more as a poll gimmick rather than the real intention of Mr. Modi goverment.

बहुत ही सार्थक योजना है | लेकिन पूरा इंटरनेट खोज लिया , कहीं पर भी इस योजना के क्रियान्वयन पर जानकारी नहीं मिली | मतलब ये कि मान लीजिए किसी किसान को बिमा करवाना है तो कैसे करेगा ? कहाँ संपर्क करेगा ? कोई मोबाइल एप या नम्बर ? स्थानीय स्तर पर कोई ऑफिस या अधिकारी जहाँ से यह फसल बीमा होगा ? कृपया बीमा करवाने की प्रक्रिया बताएं ताकि किसानों को हम बता सकें जागरूक करें क्योंकि मन की बात में आ० मोदी जी ने नागरिकों से किसानों को जागरूक करने की अपील की है लेकिन जब प्रक्रिया मालूम नहीं होगी तो क्या बताएंगे ?

Please reply as soon as possible.

Its very good scheme. Please tell me how to apply for this.

PMFBY is a very good scheme for us.pls inform me how can apply for scheme?

PMFBY is a very good scheme for farmers but for a village farmer its very difficult to connect to this type of schemes.

Please suggest me how I can apply for this scheme.

Sir,

This is really a very appropreate and

need of the hour decision by government

of India.However , would anyone inform

me please regarding how thousands of farmers in Assam and other NE states

would compensate themselves the loses

incurred by them every year due to flood.

Thanking you

Jayanta

How can Process of Fasal bima

who can i buy pmfby & where i contact i do farming for one year contract this is raise to next year ,and what document submit to buy pmfby

PMFBY is a very good scheme for farmers But Individual Farmer Can Claim For His Person Losses Or Insure As Per District Wise Losses Declared by Goverment ?

Hi Sir,

Its nice scheme, please let us know, how to apply it, is this is right time go and ask local SBI Branch.

Regards

Jaikumar

Please provide information application form process for this yojana

I have taken weather based insurance from SBI insurance on July 2017

How should report when losses due to heavy rain/hail stones/strong wind

Please provide the toll pre no for reporting

please contact your bank

good yogana

nice